Few aspiring restaurateurs have the cash on hand to get their dream off the ground. That’s where investors come in. But for the uninitiated, the world of raising money for a new business can be intimidating and mysterious.

Inspiring someone to invest in you is a gradual process. Nearly no one will give you money after just one meeting. It helps to look at what you’re doing as building lasting relationships, not as one-time transactions.

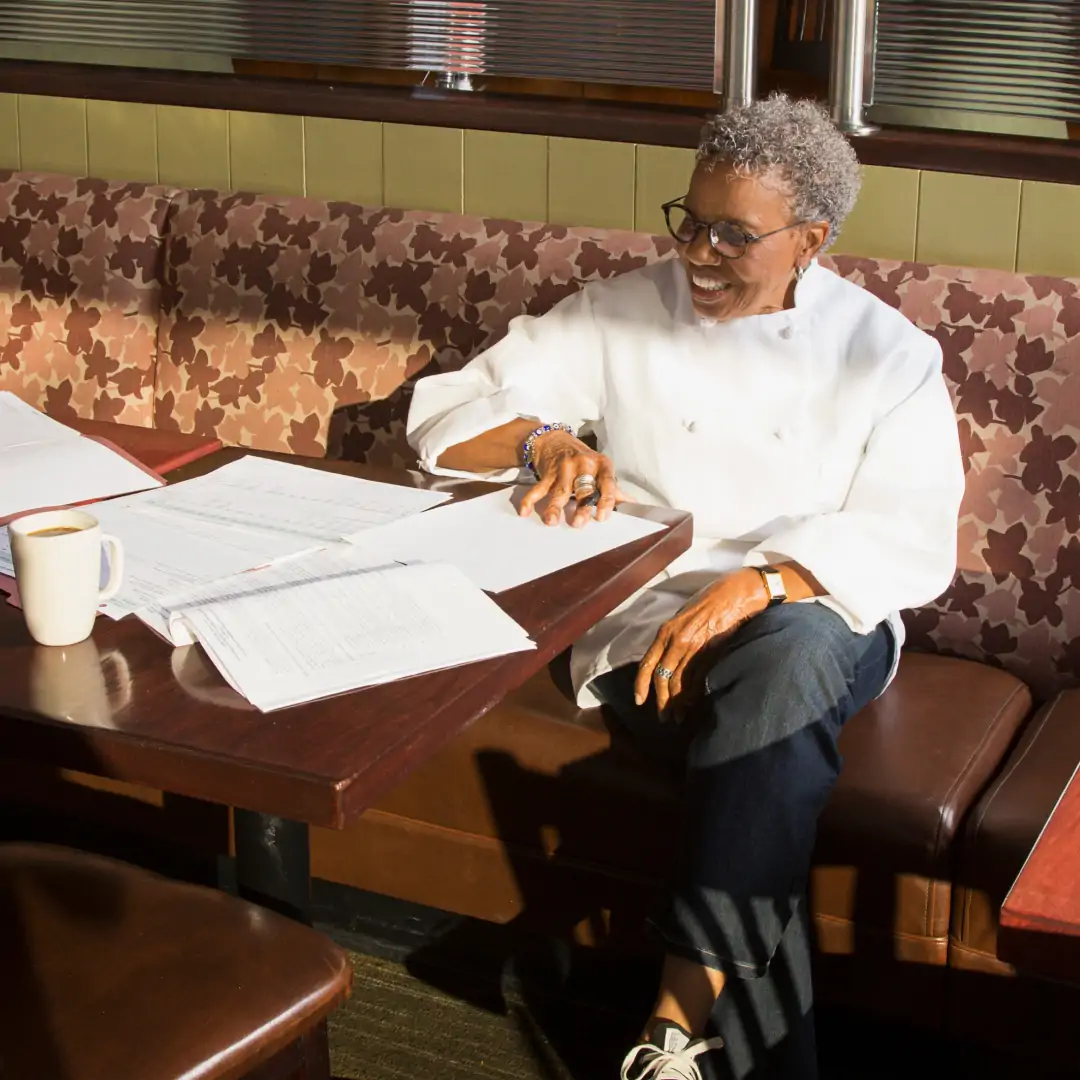

Many restaurateurs and investors compare the process to dating. Along the way, you’ll get to know each other. Take the time to figure out if your areas of expertise complement one another, if your passions align, and if your personalities click. Your investors don’t need to be your best friends, but it doesn’t make sense to do business with people you don’t trust. When appropriate, try dining in a restaurant with a potential investor and using the backdrop as an opportunity to discuss your concept and establish some common ground.

Pitch meetings

A pitch meeting is exactly what it sounds like—the first time you meet with a potential investor is your opportunity to present your concept and get them excited about it. Some people will request a copy of your business plan in advance of the meeting (yes, you should send it to them), and if not, bring them a copy to keep. This is also where your pitch deck will come in handy. Be ready to explain who you are, how you came to this idea, and most importantly, why the market needs your restaurant.

“The first five to 10 minutes are crucial, especially for people that get pitched all the time,” says Mike Harden, co-founder and senior partner at venture capital firm ARTIS Ventures. “In that first meeting, just focus on getting them excited. Don’t focus on too many details, just present the core of what you’re doing and if it meshes with that person and they’re excited about it then you’ll earn yourself another meeting.”

If the relationship doesn’t quite click in this first meeting, don’t throw away their email address. Keep them on your list and invite them to any events you may host on behalf of your future restaurant. You never know if and when that person may warm up to the idea.

Site visits

If you have a location secured while you’re in the pitching process, invite potential investors to meet you at your site. The more you can show the potential investors tangible, visual elements of your future restaurant, the better they will understand what you’re planning to build.

However, you’ll also probably need to hold pitch meetings before you’ve secured a location. Signing a lease requires a good chunk of capital but plus the confidence that you’ll be able to find the rest of the funding you need.

Charles Bililies, founder of Souvla in San Francisco, says that this was one of the most challenging parts of fundraising for him. Almost everyone that was interested in his concept would immediately ask where the restaurant was going to be.

Despite having a well-researched list of neighborhoods ready to go, the response he got to that was mostly, “Let me know when you have a location.” This can turn into a real chicken-and-egg situation, especially in cities like San Francisco, where finding and securing the right site your restaurant requires can take years.

If investors commit to you before you’ve found a location, be sure to meet with them again on-site to give them a status update, show off your new site, answer questions, and get them excited about the progress you’ve made.

Friends, family, and you

Before asking anyone to invest in your restaurant, figure out how much you’ll personally be able to contribute. Even if it’s nowhere near the six-figure range, any outside investor will want to see that you’ve got some skin in the game.

After you’ve assessed how much you’ll be able to chip in, your friends and family will likely be the next group of people you speak to about raising money. For the sake of your business and your personal relationships, be pragmatic and professional in your approach. Treat each person in this group like any other potential investor.

Regardless of your personal ties, you’re asking them to give you real money and to take a real risk on your business. Both of you need to be emotionally and financially prepared for the business to fail. If the idea of not being able to pay them back is too tough to bear, it’s probably best that you don’t ask.

Even if you’ve told your older brother about the restaurant of your dreams for the past 20 years, don’t waste a valuable opportunity to practice your pitch and answer questions. It takes time to get comfortable with the process of presenting your idea to new people, so use your friends and family to help you build confidence.

What makes your restaurant a good investment?

First of all, an investor wants to know that the financial agreement (ownership structure and payback terms) is reasonable. Next, they’ll assess the feasibility of your concept and whether it’s something they’re interested in or passionate about.

Harden says, “Of course, the investor needs to know that you have a good business model that’s based on conservative projections and not a best-case scenario, but once that’s established, they’re looking at the vision, the concept, and the passion behind it.”

Matt Hemsley, one of the primary investors in Spoon and Stable in Minneapolis, stresses:

“Even if you know that the economics are sound, they’re never going to be the compelling part of the deal. Ever. If you’re looking at high-net-worth folks who are sophisticated investors and you say, ‘Please invest in this hugely risky operation with low financial returns for the sake of making money,’ they’ll look at you cross-eyed. For that reason, finding investors whose passions align with yours is really important.”

The moral of the story is, if you’ve done your due diligence up to this point, you should be able to walk into these meetings with confidence, tell your story, and make an emotional connection with the investor. Ultimately, how passionate that investor is about what you’re doing will determine their willingness to invest.

What makes someone a good investor

As a restaurateur, you want to find investors who complement you and add value to your business beyond providing capital. Don’t sign on investors if you don’t value their opinion. Look for investors with experience in the restaurant industry or in areas that would be beneficial to a restaurateur. A good investor is a good advisor.

Also, do your homework. Hemsley says, “Really get to know and try to understand who you’re doing business with. People build reputations over time and it’s not that hard to figure out if this is someone whose previous business partners would all do business with him or her again or if it’s someone that’s burned every bridge that they’ve crossed.”

How to find investors

Well folks, if you were hoping for a list of phone numbers in this section, we’re sorry to disappoint. There is no easy way to find investors and raise money.

“You can sign up for every list and go down every rabbit hole, but it just never works. The truth is, there isn’t any other way outside of just hustling and picking up the phone and calling every single person you know,” says Harden.

For Bililies, outside of friends and family, all of his investors came from networking. The group of people that funded his business wasn’t what he initially expected it to be. His first investors referred him to other investors, and that process, repeated many times, allowed him to raise the capital he needed to start Souvla.

There is no ideal number of investors. The key is setting a minimum amount for investment and then sticking to it. You don’t want a lot of people investing very small amounts.

Investor relations

Many restaurant owners have found themselves in difficult situations as a result of not being clear about the benefits of being an investor before any contracts are signed.

The contract and other investment documents that your attorney crafts for your investors will include specifics about what each party can and cannot do and how decisions relating to the business will be made, but some of the perks that your investors may be interested in aren’t appropriate for inclusion in legal documents.

With that said, it doesn’t mean that they shouldn’t be discussed. If an investor calls for a reservation for 10 people on Friday night at 8 pm, how will you respond? Your investors should know in advance what special treatment they can expect.

Some restaurants host investor dinners a couple of times a year to show appreciation. Restaurateurs need research investor perks because some of them, like meal credits, can be taxable to the investor and will incur an additional cost for the restaurant. Regardless of what you offer, make sure everyone is on the same page so that no one feels unsatisfied or taken advantage of down the line.

The key to healthy investor relations is managing expectations and creating a consistent flow of information. Regular updates go a long way to maintaining strong relationships with your investors. You may have to answer some uncomfortable questions at times (particularly when numbers are behind schedule), but there’s no substitute for having an ongoing, open conversation with the folks who are financing your successful restaurant.