- View all solutions

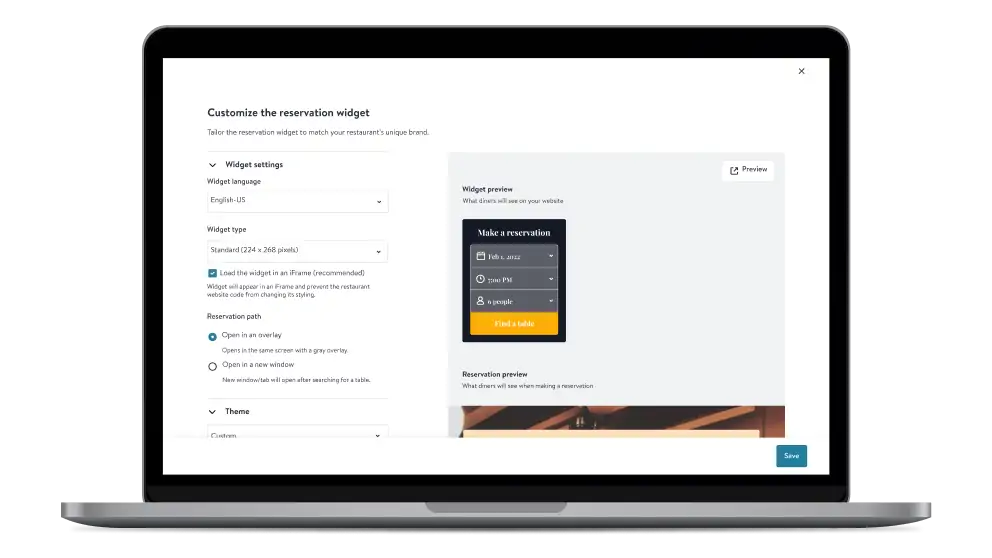

- Restaurant reservation software

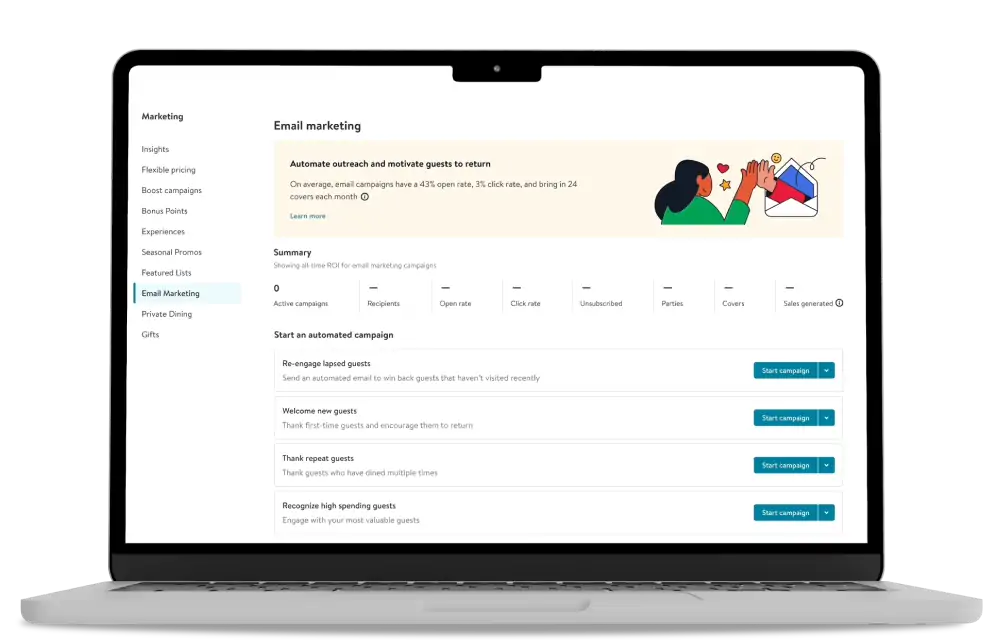

- Digital marketing solutions

- Restaurant table management

- Experiences

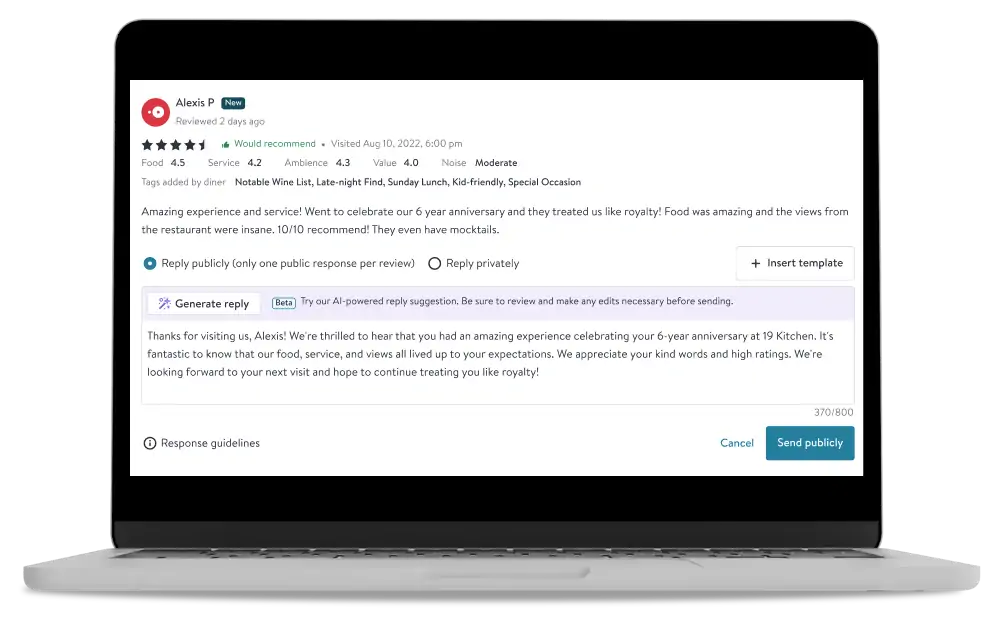

- Reputation and reviews

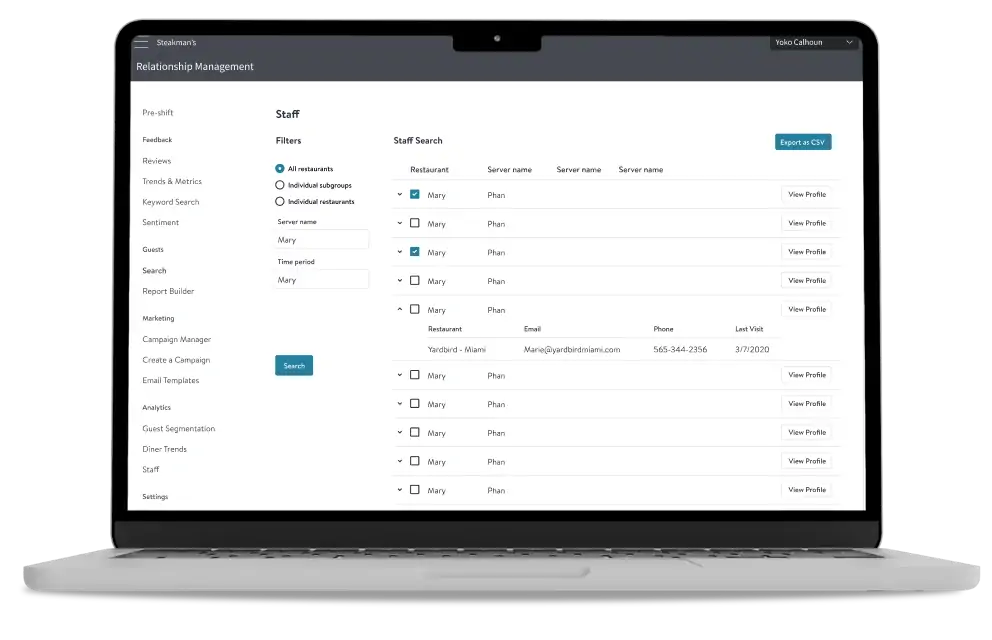

- Relationship management

- OpenTable integrations

- For restaurants

- For restaurant groups

- For bars and wineries

- For hotels and casinos

- Robust reporting and insights

- The largest diner network

- The best customer service

- Pricing

- View all solutions

- Restaurant reservation software

- Digital marketing solutions

- Restaurant table management

- Experiences

- Reputation and reviews

- Relationship management

- OpenTable integrations

What restaurants should know about coronavirus relief under the CARES Act

The Coronavirus Aid Relief and Economic Security (CARES) Act includes a wide range of measures designed to provide economic assistance to small businesses, including restaurants, in the wake of COVID-19, primarily through giving them access to the U.S. Small Business Administration’s (SBA’s) general business loan program (7(a) loans) and economic injury disaster loans (EIDLs), deferments for certain existing loans, and loan forgiveness. It also expands eligibility for unemployment insurance benefits for certain employers and employees. We encourage you to visit the SBA’s website to learn more about these programs and how to apply.

Below are some basic FAQs and resources to help restaurants better understand the CARES Act loan and unemployment benefits:

- What loans are available under the CARES Act?

- Who is eligible to apply for loans under the CARES Act?

- How can I spend any loan amounts I receive?

- Will my loan be eligible to be forgiven?

- What unemployment benefits does the CARES Act offer for any employees I had to let go?

- What other resources can I read to learn more?

1. What loans are available under the CARES Act?

7(a) Loans – Paycheck Protection Program: The purpose of this $349 billion loan fund is to help businesses maintain their payroll levels, but the funds can also be used towards rent, utility, or mortgage interest obligations. 7(a) loans are fully guaranteed by the U.S. government through December 31, 2020, and are eligible to be forgiven (i.e., not required to be repaid) subject to restrictions. The maximum loan amount is the lesser of: (x) $10 million and (y) 2.5x the average total monthly payroll costs incurred in the one year period before the loan is made (adjusted for seasonal businesses).

Economic Injury Disaster Loans: $10 billion in funding to expand the SBA’s Economic Injury Disaster Loan (EIDL) program for those substantially impacted by Covid-19. EIDL loans can be used generally for working capital, operational costs including rent, utility, or mortgage obligations and payroll to offset the impact of Covid-19 on a business. Applicants may request an advance of up to $10,000, to be provided within three days of SBA’s receipt of an application. Loan amounts are determined by the SBA up to a general cap $2 million. Applicants are not required to repay advance payments if they are later denied an EIDL loan. EIDL loans are not eligible for forgiveness.

2. Who is eligible to apply for loans under the Cares Act?

7(a) Loans / Paycheck Protection Program: Single-location restaurants that employed 500 or fewer individuals (including full-time, part-time, or on other bases) and were operational on February 15, 2020 and paying payroll taxes are eligible to apply.

For restaurants that have more than one location, they are eligible if they employ 500 or fewer individuals per physical location and are assigned to NAICS Sector 72 (accommodation/food services). This includes eligible franchises and groups.

SBA is also waiving its existing rules for affiliation for franchises and groups and will consider each location a separate business for (a) franchises that are approved on the SBA’s Franchise Directory or (b) those receiving funding through the Small Business Investment Company Program.

EIDLs Restaurants that employ 500 or fewer individuals that have suffered “substantial economic injury” from COVID-19 are eligible to apply. There is no waiver of affiliation rules for franchises or groups for EIDLs.

Note: If a business receives a 7(a) loan for employee salaries, payroll support, mortgage payments, and/or other debt obligations, it will not be able to receive an EIDL for the same purpose.

3. How can I spend any loan amounts I receive?

7(a) loan funds may be used for:

- Payroll costs (including payment of cash tip or equivalent)

- Continuation of health care benefits (including paid sick or medical leave, or insurance premiums)

- Employee salaries or commission (for those making less than $100K as prorated for the covered period of February 15, 2020 to June 30, 2020, including anticipated bonuses)

-

- Current advice is to exclude those making over $100K

- Mortgage interest obligations

- Rent or utility payments

- Interest on other outstanding debt

Failure to use the loan funds for a permitted purpose may result in forfeiture of the right to obtain any future loan forgiveness and other penalties.

EIDL loan funds may be used to pay for:

- Working capital necessary to carry the business concern until resumption of normal operations, including rent, mortgage obligations, etc.

- Expenditures necessary to alleviate the specific economic injury

- Payroll & sick leave to employees

4. Will my loan be eligible to be forgiven?

7(a) loan borrowers may be eligible for loan forgiveness (i.e., not required to be repaid) in an amount equal to the amount incurred / payments made during an eight week period following the loan date for:

(1) Payroll costs for individuals making less than $100K as prorated for the covered period of February 15, 2020 to June 30, 2020, including anticipated bonuses (current advice is to exclude those making more than $100K),

(2) Interest payments on any mortgage incurred prior to February 15, 2020;

(3) Payment of rent on any lease in force prior to February 15, 2020; and

(4) Payment on any utility for which service began before February 15, 2020.However, the amount forgiven would be reduced in proportion to any reduction in employees retained or reduction in employee pay. Adjustments to this formula are available for borrowers with seasonal employees.

If a borrower re-hires employees who were terminated earlier and/or the borrower eliminates a reduction in salaries it has made by June 30, 2020, it will not be penalized for previously reducing payroll or salaries/wages.

EIDL loans are not eligible for forgiveness at this time; however, businesses that have already applied for or received EIDLs due to economic injury due to COVID-19 can look to refinance their EIDL loans under the 7(a) loan program to benefit from its loan forgiveness provisions.

5. What unemployment benefits does the CARES Act offer for any employees I had to let go?

Existing recipients

Nearly all individuals receiving traditional unemployment benefits will receive an increase of $600 per week through July 31, 2020.Pandemic Unemployment Assistance Program

Provides assistance to individuals who have exhausted their unemployment benefits, are not traditionally eligible for unemployment, and are not eligible for the Pandemic Emergency Unemployment Compensation Program.

- Nearly any individual whose employment is adversely impacted by COVID-19 (other than those able to telework or receive paid leave) would be eligible for up to 39 weeks of benefits.

- Covers weeks of unemployment directly attributable to COVID, from January 27, 2020 to December 31, 2020.

Pandemic Emergency Unemployment Compensation Program

Would provide thirteen weeks of emergency UI to individuals who have exhausted all rights to regular UI benefits for a benefit year or have no rights to regular compensation through July 31, 2020. Individuals would have to be able, available, and actively seeking work in order to be eligible.

6. What other resources can I read to learn more?

Here are some further outside resources which provide further guidance and analysis on the CARES Act:

- Coronavirus (COVID-19): Small Business Guidance & Loan Resources (U.S. Small Business Administration)

- FAQs: Small Business Loans Under the CARES Act (Latham & Watkins LLP)

- Coronavirus Legislative Update: The CARES Act Becomes Law (Arnold & Porter LLP)

- SBA Loans Under the CARES Act (Foley & Lardner LLP)

Disclaimer: This page is for informational purposes only and does not constitute legal advice, please visit the external resources noted herein for more information on the CARES Act.

SolutionsWhy OpenTableMoreGET OPENTABLE

Need help deciding which option is best for you? Give us a call at

Join us onCopyright © 2024 OpenTable, Inc. 1 Montgomery St Ste 500, San Francisco CA 94104 – All rights reserved.OpenTable is part of Booking Holdings Inc., the world leader in online travel & related services.